[Sumitomo Mitsui Financial Group, Inc.]Strategic Joint Business in Leasing and Auto Leasing Businessesbetween Sumitomo Corporation Group and Sumitomo Mitsui Financial Group(1/1)

To whom it may concern:

Sumitomo Corporation

(Code No. 8053)

Sumisho Lease Co., Ltd.

(Code No. 8592)

Sumisho Auto Leasing Corporation

Sumitomo Mitsui Financial Group, Inc.

(Code No. 8316)

SMBC Leasing Company, Limited

SMBC Auto Leasing Company, Limited

Strategic

Joint Business in Leasing and Auto Leasing Businesses

between

Sumitomo Corporation Group and Sumitomo Mitsui Financial Group

l Sumitomo Corporation (hereinafter referred to as “SC”; Mr. Motoyuki Oka, President and CEO);

l

Sumisho Lease

Co., Ltd. (hereinafter referred to as “Sumisho Lease”; Mr. Hideki Yamane, President);

l Sumisho Auto Leasing Corporation, a wholly owned subsidiary of SC (hereinafter referred to as “Sumisho Auto Lease”; Mr. Hironori Kato, President);

l

Sumitomo Mitsui Financial

Group, Inc. (hereinafter referred to as “SMFG”; Mr. Teisuke Kitayama, President),

l SMBC Leasing Company, Limited, a wholly owned subsidiary of SMFG (hereinafter referred to as “SMBC Leasing”; Mr. Koji Ishida, President); and

l

SMBC Auto Leasing

Company, Limited, a wholly owned subsidiary of SMBC Leasing (hereinafter

referred to as “SMBC Auto Leasing”;

Mr. Sumio Saito, President),

today announced that they have reached a basic agreement to pursue strategic joint businesses in leasing and auto leasing, summarized as follows:

1.Strategic Joint Business in Leasing and Auto Leasing

Businesses

The

domestic leasing market, which makes up about 10 percent of the private-sector

capital spending, has been expanding among large as well as small-to-medium

companies due to increase in capital spending sustained by their improvements

in business performance, and the market size has reached 8 trillion yen. As for the domestic auto leasing market,

the number of automobiles held for leasing purposes still only makes up less

than 4 percent of the total number of automobiles in Japan, and therefore

further growth of the auto leasing market is expected as Japanese corporations

become more interested in improving efficiency. On the other hand, there are

uncertainties in both markets, such as the concerns about rising interest rates

and modifications of the accounting standard for leasing.

Given these circumstances, the Sumitomo Corporation Group and the Sumitomo Mitsui Financial Group agreed to position their leasing and auto leasing businesses as strategic joint business and to jointly aim to establish the best leasing and auto leasing businesses in Japan through the merger of SMBC Leasing and Sumisho Lease, and the merger of Sumisho Auto Lease and SMBC Auto Leasing. Sumisho Lease and Sumisho Auto Lease, utilizing various value chain of the Sumitomo Corporation Group, have unique customer base and know-how. On the other hand, SMBC Leasing and SMBC Auto Leasing, leveraging capabilities of the Sumitomo Mitsui Financial Group to provide financial solutions, have different customer base and know-how. These mergers will enable two groups to combine different customer base and know-how of each group.

In merging SMBC Leasing and Sumisho

Lease, and also in merging Sumisho Auto Lease and SMBC Auto Leasing, we will make it a basic

policy to provide our customers with value-added products and services by

recognizing each other as best partners and pursuing best practices (such as

thorough fairness, transparency, and a merit system) under mutual respect and

spirit of cooperation, and aim for the early realization thereof. In addition, SC and SMFG will fully cooperate as parent

companies, and will render assistance to the fullest extent for the development

of both businesses.

2.Summary

of Strategic Joint Business

(1) Joint

Business in the Leasing Business (Merger of SMBC Leasing and Sumisho Lease)

(i) Goal

・

Achieving the highest

volume of leases being handled in

・

Creating a high

quality leasing company that can respond appropriately to market needs which

are becoming increasingly sophisticated, by combining and blending the know-how

of SMBC Leasing as a subsidiary of a financial institution and Sumisho Lease as

a trading firm’s subsidiary, thereby promoting diversification and differentiation

of products and providing more value-added products with freeing from the

traditional approaches.

・

Creating a

strong management culture to effectively adapt to environmental changes, by

strengthening funding capabilities and by promoting management efficiency.

(ii) Form of Merger

SMBC Leasing

and Sumisho Lease plan to merge on

Note: Each step

will be conducted subject to the approvals at the general shareholders’ meetings

of each party and/or of the relevant authorities, etc. under applicable laws

and regulations.

(iii) Summary

of New Leasing Company (Planned)

Business description: General leasing business

Address of the head office: 9-4,

3-chome, Nishi-Shimbashi, Minato-ku,

Shareholder composition: SMFG 55% (a consolidated subsidiary of SMFG)

SC 45% (an equity-method affiliate company of SC)

Representative: Representative Chairman of the Board (Co-CEO)

Mr. Hideki Yamane (current President of Sumisho Lease)

Representative President (Co-CEO)

Mr. Koji Ishida (current President of SMBC Leasing)

Details of the merger such as the trade name and amount of capital, etc. will be determined prior to the execution of the merger agreement.

(iv) Summary of Accounting Treatment

The

new leasing company is expected to become a consolidated subsidiary of SMFG and

an equity-method affiliate company of SC. This merger is an acquisition under the accounting standards for

business combinations, and upon this merger taking effect, SMFG plans to

recognize goodwill for purposes of its consolidated financial statements. However, the amount to be recognized has

not yet been determined at present.

(2) Joint Business in the Auto Leasing Business (Merger of Sumisho Auto Lease and SMBC Auto Leasing)

(i) Goal

・

Winning a place in

the auto leasing industry that is becoming increasingly competitive and establishing

a structure aiming to be ranked number one with respect to the market share, based

upon the high-quality customer bases of both the Sumitomo Corporation Group and

the Sumitomo Mitsui Financial Group.

・

Establishing a highly

profitable company by combining high-value-added services based on Sumisho Auto

Lease’s value chain and business network of SMBC Auto Leasing.

・

Achieving better

customer satisfaction by combining and blending the know-how of Sumisho Auto

Lease as a trading firm’s subsidiary and SMBC Auto Leasing as a subsidiary of a

financial institution, thereby pursuing various services.

(ii) Form of Merger

Sumisho Auto Lease and SMBC Auto

Leasing plan to merge on

,

(iii)

Summary of New Auto Leasing Company (Planned)

Business description: Leasing business of various automobiles

Address of the head office: 20-2, 3-chome,

Nishi-Shinjuku, Shinjuku-ku,

Shareholder composition: SC 60% (a consolidated subsidiary of SC)

SMFG 40% (an equity-method affiliate company of SMFG)

Representative: Representative Chairman of the Board (Co-CEO)

Mr. Katsuyuki Shibabuki (the current Chairman of the Board of SMBC Auto Leasing)

Representative President (Co-CEO)

Mr. Hironori Kato (the current President of Sumisho Auto Lease)

Mr. Sumio Saito, the current President of SMBC Auto Leasing is scheduled to become Representative Director, Vice President of the new auto leasing company.

Details of the merger such as the trade name and amount of capital, etc. will be determined prior to the execution of the merger agreement.

(iv)Summary of Accounting Treatment

The new

auto leasing company is expected to become a consolidated subsidiary of SC and

an equity-method affiliate company of SMFG. SC will apply the accounting standard under

the accounting principles generally accepted in the

(3) Business Cooperation

The Sumitomo Corporation Group and the Sumitomo Mitsui Financial Group will engage in necessary business cooperation such as introducing customers and deals to the merged companies so as to jointly promote the leasing business and the auto leasing business, and they will develop the structure with which the merged companies can effectively and smoothly utilize customer bases and know-how of both the Sumitomo Corporation Group and the Sumitomo Mitsui Financial Group.

3.System for Promoting Joint Business

For the purpose of smoothly implementing the joint business in leasing and auto leasing businesses, a “Merger Preparatory Committee” will be established for each business. The committee for the leasing business will be chaired by the presidents of SMBC Leasing and Sumisho Lease, and the one for the auto leasing business will be chaired by the presidents of Sumisho Auto Lease and SMBC Auto Leasing. At the same time, separate subcommittees to discuss individual topics such as planning, financial accounting, human resource management, system development, etc. will be constituted under the “Merger Preparatory Committee.” In addition, a merger preparatory office will be constituted in each of the four companies.

4. Schedule (Planned)

(1) Leasing Business

May, 2007 In case SC cannot acquire all the shares of Sumisho Lease:

Execution of a share

exchange agreement

(SC and Sumisho Lease)

June, 2007 Annual general meeting of shareholders to approve the share exchange (SC and Sumisho Lease)

If the share exchange is deemed to

be a simplified share exchange (“kan’i kabushiki kokan”) or a short-form share exchange (“ryakushiki kabushiki kokan”), a resolution of approval by the

general meeting of shareholders may not be needed.

July, 2007 Delisting of shares of Sumisho Lease

August, 2007 SC

makes Sumisho Lease its wholly-owned subsidiary by the share

exchange

August, 2007 Extraordinary general meeting of shareholders to approve the merger (SMBCLeasing and Sumisho Lease)

(2) Auto Leasing Business

August, 2007 Extraordinary general meeting of shareholders to approve the merger (Sumisho Auto Lease and SMBCAuto Leasing)

SMFG plans

to make SMBCAuto Leasing its wholly-owned subsidiary by acquiring

all the shares of SMBCAuto Leasing from

SMBC Leasing,prior tothe merger on

The schedule above may be changed upon consultation among the parties upon unforeseen circumstances.

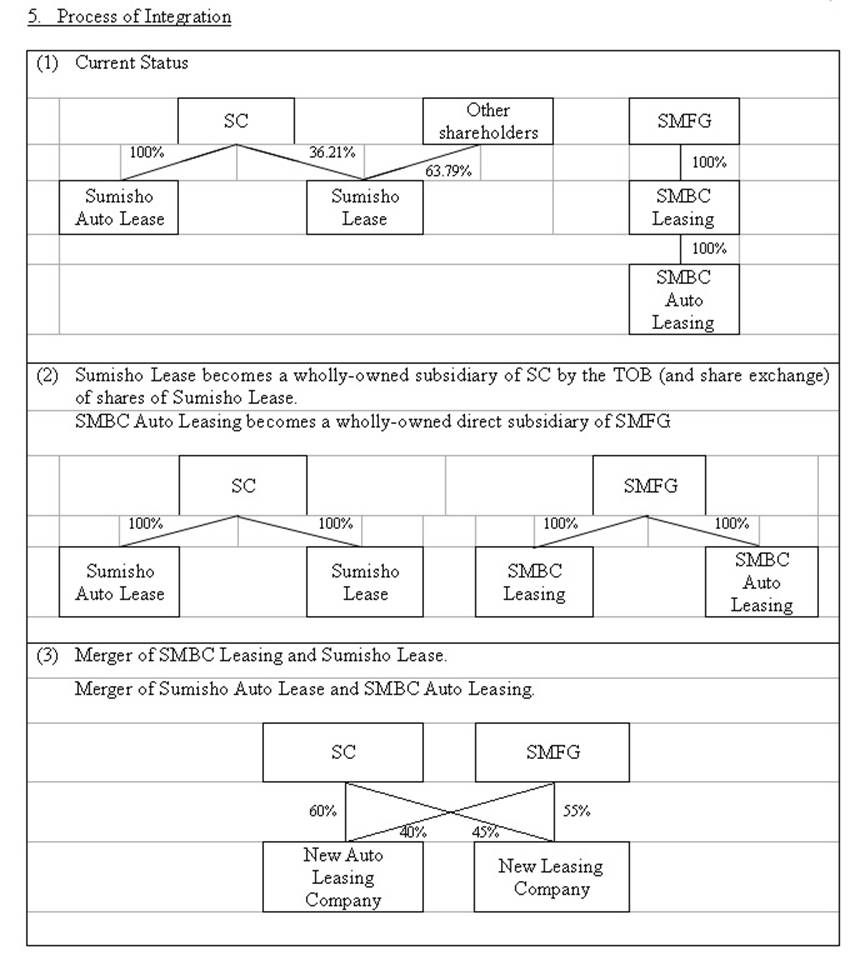

5. Process of Integration

6.Business Forecast

(1) SC:

The business forecast for the year ended march 31, 2007 is not revised as a result of this transaction.

(2) Sumisho Lease:

The business forecast for the year ended march 31, 2007 is not revised as a result of this transaction.

(3) SMFG:

The business forecast for the year ended march 31, 2007 is not revised as a result of this transaction.

7.Corporate Profile

of the Four Companies that are the Parties to the Management Integration (as of

(1)

(1) Leasing

Business

Company Name |

Sumisho Lease Co., Ltd. |

SMBC Leasing Company, Limited |

Representative |

President Hideki

Yamane

|

President Koji Ishida* |

Location |

5-33, Kitahama 4-chome, Chuo-ku,

|

9-4, Nishi-Shimbashi 3-chome, Minato-ku,

|

Date of Incorporation |

|

|

Main Business |

General leasing business |

General leasing business |

Number of Employees |

589 |

893 |

Capital |

14,760 million Yen |

82,600 million Yen |

Total Number of Issued Shares |

Common Stock 43,396 thousand shares |

Common Stock 30,000 thousand

shares

Preferred Stock 1,375 thousand shares |

Amount of Shareholders’ Equity |

106,670 million Yen |

179,719 million Yen |

Total Assets |

1,163,734 million Yen

|

1,805,247 million Yen

|

Fiscal End |

March 31 |

March 31 |

Principal Shareholders and Voting Right Ratio |

Sumitomo Corporation 36.21% STB Leasing Co., Ltd. 8.13% |

SMFG 100% |

Main Banks |

The Sumitomo Trust and Banking Company, Limited Sumitomo Mitsui Banking Corporation |

Sumitomo Mitsui Banking Corporation |

* Elected on

(2)

(2) Auto

Leasing Business

Company Name |

Sumisho Auto Leasing Corporation |

SMBC Auto Leasing Company, Limited |

Representative |

President Hironori Kato |

President Sumio

Saito

|

Location |

20-2, Nishi-Shinjuku 3-chome, Shinjuku-ku,

|

13-12, Nihombashi Kayaba-cho 1-chome, Chuo-ku,

|

Date of Incorporation |

|

|

Main Business |

Leasing business of various vehicles |

Leasing business of various vehicles |

Number of Employees |

503 |

514 |

Capital |

2,750 million Yen |

4,200 million Yen |

Total Number of Issued Shares |

19,415 thousand shares |

15 thousand shares |

Amount of Shareholders’ Equity |

33,845 million Yen |

14,146 million Yen |

Total Assets |

167,541 million Yen |

249,976 million Yen |

Fiscal End |

March 31 |

March 31 |

Principal Shareholders and Voting Right Ratio |

Sumitomo Corporation 100% |

SMBC Leasing Company, Limited 100% |

Main Banks |

The Sumitomo Trust and Banking Company, Limited |

Sumitomo Mitsui Banking Corporation |

8.Business

Results for the Most Recent Three Fiscal Years (Unit: Millions of Yen, except

for per share data)

|

Sumisho Lease (Consolidated)

|

||

Fiscal Year

Ended

|

March

2004

|

March

2005

|

March

2006

|

Net Sales

|

413,028

|

430,872

|

450,482

|

Operating Income

|

18,117

|

21,861

|

25,731

|

Ordinary Income

|

20,631

|

24,714

|

28,363

|

Net Income

|

12,321

|

15,158

|

17,080

|

Net Income Per

Share

|

283.41

Yen

|

349.03

Yen

|

393.35

Yen

|

Cash Dividends

Per Share

|

24.00

Yen

|

30.00

Yen

|

40.00

Yen

|

Shareholder’s

Equity Per Share

|

1,760.54

Yen

|

2,072.10

Yen

|

2,727.32

Yen

|

|

SMBC Leasing (Non-Consolidated)

|

||

Fiscal Year

Ended

|

March 2004

|

March 2005

|

March 2006

|

Net Sales

|

553,011

|

589,179

|

619,749

|

Operating Income

|

23,267

|

28,028

|

32,240

|

Ordinary Income

|

14,556

|

20,177

|

26,729

|

Net Income

|

6,314

|

12,476

|

17,560

|

Net Income Per

Share

|

209.47 Yen

|

527.73 Yen

|

546.84 Yen

|

Cash Dividends

Per Share: Common Stock

|

0.00 Yen

|

45.00 Yen

|

78.00 Yen

|

Shareholder’s

Equity Per Share

|

1,863.51 Yen

|

3,437.32 Yen

|

4,118.81 Yen

|

|

Sumisho Auto Lease

(Non-Consolidated)

|

||

Fiscal Year

Ended

|

March 2004

|

March 2005

|

March 2006

|

Operating

Revenues

|

85,804

|

91,643

|

95,282

|

Operating

Income

|

7,781

|

9,139

|

7,904

|

Ordinary Income

|

7,858

|

9,141

|

7,931

|

Net Income

|

4,416

|

5,403

|

4,686

|

Net Income Per

Share

|

226.73 Yen

|

276.44 Yen

|

239.89 Yen

|

Cash Dividends

Per Share

|

24.00 Yen

|

26.00 Yen

|

26.00 Yen

|

Shareholder’s

Equity Per Share

|

1,273.99 Yen

|

1,524.51 Yen

|

1,741.76 Yen

|

|

SMBC Auto Leasing

(Non-Consolidated)

|

||

Fiscal Year

Ended

|

March 2004

|

March 2005

|

March 2006

|

Operating

Revenues

|

95,331

|

105,558

|

116,771

|

Operating

Income

|

3,077

|

3,486

|

3,656

|

Ordinary Income

|

3,031

|

3,463

|

3,642

|

Net Income

|

1,694

|

1,539

|

1,795

|

Net Income Per

Share

|

144,440.97 Yen

|

131,943.66 Yen

|

119,682.13 Yen

|

Cash Dividends

Per Share: Common Stock

|

25,000.00 Yen

|

33,334.00 Yen

|

33,334.00 Yen

|

Shareholder’s

Equity Per Share

|

450,425.89 Yen

|

853,790.53 Yen

|

943,114.03 Yen

|

(Contacts

for inquiries about this matter)

Sumitomo

Corporation

Public

Relations Department Mr.

Iba TEL:

03-5166-3089

Sumisho

Lease Co., Ltd.

Business

Planning Department Mr.

Matsubayashi TEL:

03-3515-1906

Sumisho

Auto Leasing Corporation

Operation

Department Mr.

Oguma TEL:

03-5358-6388

Sumitomo

Mitsui Financial Group, Inc.

Public

Relations Department Mr.

Morishima TEL:

03-5512-2678

SMBC

Leasing Company, Limited

Planning

Department Mr.

Hiratoko TEL:

03-5404-2301

SMBC

Auto Leasing Company, Limited

Management

Planning Department Mr.

Hayashi TEL:

03-3660-8200

End of Document

This press

release contains information about future business prospects, etc. Please

note that the information provided in this press release is based on the predictions

of the management of the parties at the time of this press release and

involves risks and uncertainties. The actual results may differ from what is disclosed

here, subject to changes in business environment, etc. Furthermore, this

press release is not made for the purpose of solicitation of any kind, domestic

or foreign.

|